Notice to the Market

São Paulo, June 2, 2021 – Companhia Siderúrgica Nacional (“CSN” or “Company”) (NYSE: SID) hereby announces that CSN Resources S.A. (“CSN Resources”), a Company subsidiary, started today a foreign offer to purchase (“Offer to Purchase”) of up to all of the 7.625% Senior Unsecured Guaranteed Notes, due in 2023, issued by CSN Resources, outstanding abroad (“Notes 2023” or “Outstanding Notes”).

The Offer to Purchase will be carried out under the terms and conditions provided for in the Offer to Purchase released today.

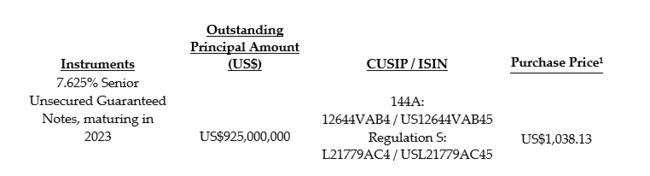

The table below summarizes the main payment terms of the Offer to Purchase:

(1) The Amount to be paid for each US$1,000 of the principal amount of the Outstanding Notes, validly offered and eligible for repurchase. In addition, interest accrued until the purchase settlement date, excluding such date, (“Accrued Interest”) will be paid.

The consummation of the Outstanding Notes in circulation by CSN Resources is conditional on the satisfaction of certain preceding conditions set out in the Repurchase Offer documents, including the issuance by the Company or its subsidiaries of a debt securities, to be placed on the international market, which will not be registered in accordance with the U.S. Securities Act of 1933, as added (“Securities Act”) or any other standard in any jurisdiction, being offered on the basis of certain waivers of registration provided for in the Securities Act.

Upon completion of the Repurchase Offer, CSN Resources and its affiliates may, at any time, redeem or repurchase any Notes 2023 that have remained in circulation on the international market.

This Notice to the Market does not constitute a sales offer, purchase or exchange, or solicitation of an offer to sell, buy or exchange, of the securities described herein. Nor shall any offer, purchase or exchange of such securities be made in any State or jurisdiction in which such offer is found to be unlawful prior to registration or qualification under the laws applicable to securities of such Securities or jurisdiction.

The Repurchase Offer was not, and will not be, registered within the Brazilian Securities and Exchange Commission (CVM). The Repurchase Offer will not be made in Brazil, except in circumstances that do not constitute a public offering in accordance with Brazilian legal and regulatory provisions.

To access the full document, click here.